Jan 21, 2016

The 50/20/30 guideline is one used by planners when working with new clients to help them understand where they spend their funds. This method can be used by anyone who is looking to work within a budget, to ensure that they have sufficient money for the month as well as savings.

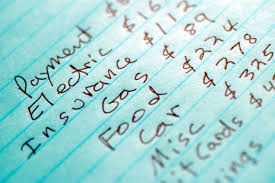

Fixed costs – These costs are those that do not vary very much during the month. For example, mortgage payments, utilities, car payments and rent. You could also add monthly memberships, like gym and subscriptions, like Netflix. A planner will suggest that you allocate 50% of your monthly earning for these costs.

Financial goals – These goals can include savings for an emergency fund, retirement fund or down payment for a home or land. Planners will suggest that you allocate 20% of your funds for this purpose. This saving will help you maintain a secure future for you and your dependants.

Flexible spending – These costs are those that vary during the month. This will include groceries, take out, shopping, entertainment and travel. A planner will recommend 30% of your monthly earnings for this area of spending. Remember that you can be flexible in this area as long as you don’t go over the allocated sum.

If your looking at putting a 50/20/30 budget guideline into action, start off with putting down all your expenses, preferably on an excel sheet. You should do this for at least a month prior to assess your pattern of spending and then allocate your funds accordingly.